With the Panama Papers being leaked, a new interest has been sparked in the international tax system. There are some wealthy folk who pay a lower percentage of income tax than the government would expect of them. An example would be Warren Buffet, who paid a lower percentage of tax than his secretary at one point. How do the rich do this? Well, there are many methods, many of which incredibly complex and stressful for tax inspectors. One of the ways they do it is simply moving to live in countries with no income tax. Anyone can do that, anyone can aim for relocation to these nations. So here are my top 10 countries with no income tax. In this article I won’t be getting into the debate of whether it’s morally acceptable to avoid tax, i’ll just be giving the facts.

Andorra

You’ve probably never heard of Andorra. It’s a tiny landlocked country in between Spain and France. It’s so small you need to look closely at the map to even notice it. But there is something that puts Andorra on the map – and that is low tax rates. They don’t even have an income tax. You get to keep all you can earn. This attracts all kinds of wealthy people from other European nations. The Andorran government has high standards, charging people 350 thousand Euros for a long term residence. But this seems like a good investment if you’re not going to pay income tax over several years. They get away with doing this as it’s an independent principality able to set it’s own laws.

Bahrain

Bahrain is another tiny nation almost no one has ever heard of. In Bahrain there is no income tax, no corporate tax, no payroll tax, and no VAT. It’s the definition of a tax haven. It is a corrupt monarchist dictatorship so I’m surprised the tax isn’t really high, or at least really high for poor people. How do they make any money? I suppose they just sell loads of oil. Bahrain would not be a good country to move to, with their human rights violations, and ongoing revolution.

Kuwait

So Kuwait is also a brutal dictatorship with no income tax, a common theme for countries with no income tax. It’s an extremely oil rich nation, which is actually why Saddam Hussein once unsuccessfully invaded it. Because of all their oil and stolen money, the Kuwaiti royals don’t need to impose any real taxes. With the world’s 6th largest oil sources, they don’t even impose a corporation tax. I think that American clock bomb kid ended up moving to Kuwait with his family so maybe it’s a good idea. It’s weird they don’t tax their citizens – they have the 4th best income per capita in the world right now.

Oman

Oman! Yet another middle-eastern dictatorship. Oman shares a border with the UAE, which we’ll get into a bit later. Oman is an absolute monarchy, with their king making all final decisions. It’s hard to run a dictatorship without the fear of being overthrown. Maybe that’s why the king doesn’t tax his people, to keep them happy. Happy people just don’t tend to revolt much. So their income tax in zero percent and it’s fairly easy to achieve resident status. Torture is a common method of interrogation and punishment in Oman, so make sure you pay the other kinds of tax like corporate. I wouldn’t want you to be tortured.

The Bahamas

Some countries with no income tax are not in the middle east and they are not even dictatorships. They are democracies in the Caribbean. The Bahamas are a former British colony who now chose to operate a low income tax through democratic methods. So they have a flat rate income tax of zero percent. The whole island was once run by pirates, who I imagine didn’t have tax either. It fell under British control to suppress pirating in the Caribbean. That was back in 1718, so why is there still no tax? Well, they use it to attract business and employment to their country. A pretty smart move for small-economy nations.

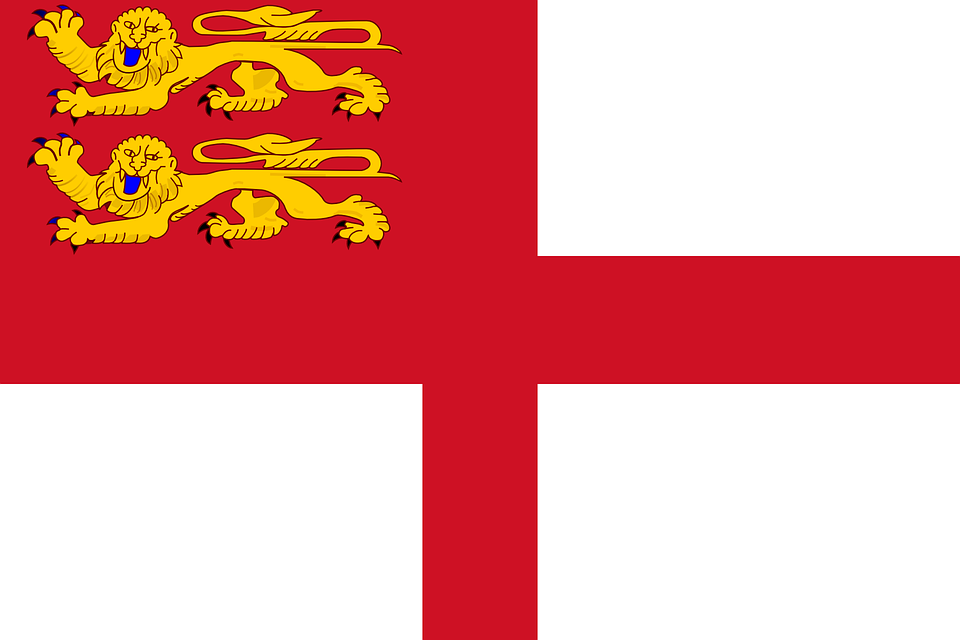

Sark

Sark is a really interesting case. It’s technically not an independent nation, but as a British crown dependency they are able to set their own tax laws. They take full advantage of this by keeping the income tax rate at non-existent. The relationship between Sark and the British government is so ancient and complex that few believe it. The laws are genuinely based on the laws of the Normans, who don’t even exist any more. I think it’s fair to include Sark on a list of countries with no income tax. If you are a British citizen, you have the option to move here, or to one of the many other British overseas territories with low tax rates.

Brunei

Brunei is a weird absolute monarchy in South-East Asia. The monarchy is incredibly brutal, making nothing of committing human rights abuses regularly. In 1962, the British military helped the monarchy survive a small revolution. After cementing their place as Brunei’s true rulers, they never introduced tax. It just isn’t a thing over there. You will have to pay tax in Brunei if you are not a national resident there. This means you would need to live in Brunei for at least 183 days of the year in order to pay no income tax there.

United Arab Emirates

As I said earlier, we’ll get into the United Arab Emirates in this list. There are so many things to criticize the United Arab Emirates for, like their human rights violations or their strict enforcement of Sharia law. Maybe this is why people tend to forget about their tax system. Their corporation is 20 percent, which isn’t that low. But their income tax is zero percent for everyone. That’s pretty egalitarian for a Sharia-law enforcing oil-baron absolute monarchy. The United Arab Emirates is basically just a collection of individual city state in the middle of the desert. So their laws differ slightly in different areas – be careful.

Bermuda

You can expect to see more than one British oversea territories in a list of countries with no income tax. Bermuda has literally no tax. The only problem with the place is the high cost of living. You’d expect this as it’s basically a magnet for international billionaires and millionaires. But this works to the advantage of Bermuda, as it’s economy is much larger than most other Caribbean islands. It’s infrastructure is much more developed, and it’s educations seems to be better too. There’s just more opportunity, mostly thanks to them having no income tax. It’s like a libertarian attempt at creating a weird Utopia.

Monaco

Monaco is like the king of all tax havens. It’s one of the most desirable areas in Europe, with many billionaires desperate to relocate there. It’s a tiny nation, where a large fortune would only afford you a small house. Probably more of an apartment if we’re being honest. In order to gain resident status in Monaco you need to be worth at least half a million US dollars, although that half a million wouldn’t get you very far in Monaco. Monaco is famous for it’s harbor always being full with expensive ships, and for having real life James Bond style super villain billionaire people living there. There are over 2 thousand millionaires residing in Monaco. The average price of real estate in Monaco is 40 thousand British pounds per square meter, which literally makes it the most expensive on earth.